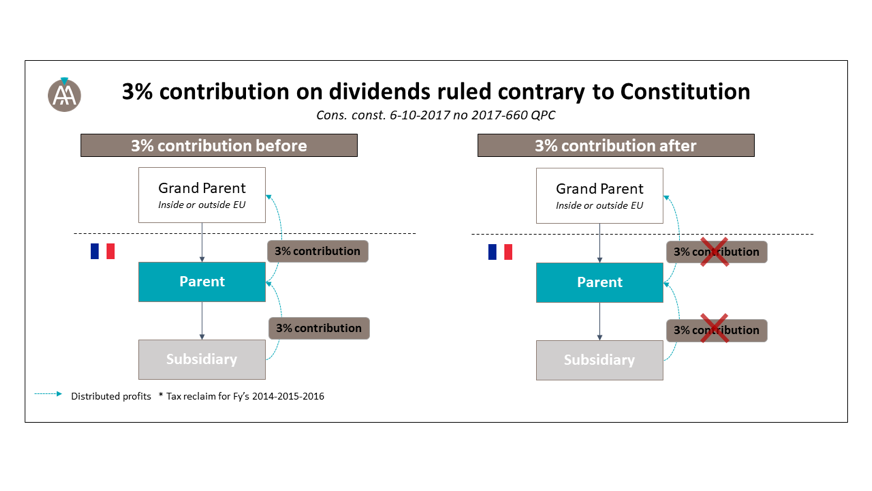

Contribution on dividends ruled contrary to the Constitution : get a refund by a tax claim

1. Did you pay 3% contribution on distributed dividends ?

French resident companies that distributed dividends were subject to an additional contribution of 3% on the amount of distributed dividends (article 235 ter ZCA of the French tax Code).

Only the following dividends distributions have been exempted from 3% contribution :

- Dividends paid by small and medium-sized enterprises (fewer than 250 people and annual turnover does not exceed 50 million or whose total annual balance sheet does not exceed 43 million).

- Dividends between companies that fulfil the conditions to belong to a consolidated tax group.

Except the two exemptions cases, all other companies subject to corporation tax were liable to a contribution of 3% on distributed dividends distributed to individual or company shareholder established in France or abroad.

If you paid the 3% contribution on the distributed dividends you can now claim the refund of this unconstitutional contribution.

2. Get a refund !

On 6 October 2017, the French Constitutional Court ruled that the 3% contribution on distributed dividends is contrary to the Constitution because it does not respect the constitutional principle of equality.

As Taxpayers you may rely on this decision to get a refund of the contribution paid in any non-statute barred years (i.e. Fys 2014-2015-2016).

The tax claim must be filed to French tax authorities before 31 December 2017 to get refund the contribution paid for Fys 2014.

Contact us : +00 33 1 40 59 90 18 or contact@agn-avocats.fr to get the refund of the tax paid since year 2014